|

Craig Steiner, u.s. Common Sense American Conservatism |

|

|

About Me & This Website My Positions On Facebook Contact Me Articles |

If you look back at the news stories of this week, it would seem the most noteworthy headlines would be the news last Sunday that AIG (which has received over a hundred billion taxpayer dollars in bailouts) was going to pay certain employees $165 million in bonuses  ; followed by the week-long soap opera of how the government would get that money back. Also on the list of news stories was President Obama's appearance on the Jay Leno show--the first time a sitting president has appeared on such a show ; followed by the week-long soap opera of how the government would get that money back. Also on the list of news stories was President Obama's appearance on the Jay Leno show--the first time a sitting president has appeared on such a show  , followed by the trivial tabloid-like harping of Obama's joke involving the Special Olympics , followed by the trivial tabloid-like harping of Obama's joke involving the Special Olympics  . . A more astute newswatcher might conclude that a more important (but less reported) news story was the effective beginning of a trade war with Mexico, much akin to mistakes made during the Great Depression. But the AIG bonus flap, Obama's appearance on the Tonight Show, and even the beginning of a trade war with Mexico weren't the news highlights of the week. Decades from now those first two items will be entirely forgotten and the trade war with Mexico will be a footnote in economic history. Why We're Printing Money To put it simply: Because Obama wants to spend more money than the U.S. Government has been able to borrow. When the government wants to spend more money than it obtains through taxation, it borrows the rest by selling government bonds (U.S. Treasuries). The government normally sells them to the private sector, both foreign and domestic (and also Social Security), and receives money which it uses to spend on whatever it wants. Eventually the holders of these bonds return them to the government and get their money back, presumably with interest (since it was a loan). It's considered the safest investment in the world because the U.S. Government has never defaulted on its debt. Last year (FY2008) the government had a deficit of $454.8 billion  . Of that, foreign countries such as China loaned us about $200 billion. The rest came from domestic sources such as U.S. citizens and other investment sources. . Of that, foreign countries such as China loaned us about $200 billion. The rest came from domestic sources such as U.S. citizens and other investment sources.  . . The problem is that, this year, we're on track for a $1.85 trillion deficit  and Obama's budget proposal for FY2010 includes a $1.7 trillion deficit. In other words, for at least this year and the next, the U.S. government wants to borrow more than four times what it did last year. Do you, as an investor, have four times more money this year to loan to the government? Most people don't, and that includes our largest foreign lender: China. and Obama's budget proposal for FY2010 includes a $1.7 trillion deficit. In other words, for at least this year and the next, the U.S. government wants to borrow more than four times what it did last year. Do you, as an investor, have four times more money this year to loan to the government? Most people don't, and that includes our largest foreign lender: China.So the harsh reality is that Obama wants to borrow and spend about $1.8 trillion this year, but the government has looked around the planet and hasn't found where it can borrow nearly that much money. Given that there isn't enough money for the U.S. Government to borrow, there are two options: The government can either spend less... or it can print more money. What happened on Wednesday was a declaration of their intention to go with the second option. Federal Reserve's Independence Destroyed The Federal Reserve is supposed to be independent. The politicians in the federal government control fiscal policy (taxing, borrowing, and spending) while the Federal Reserve independently controls the amount of money circulating in the economy. While the members of the Federal Reserve are appointed by the president and confirmed by the Senate, they are essentially independent thereafter. This independence is not accidental: We know that, given the opportunity, politicians will print money in order to pay for lots of projects that make their voters happy so those voters will re-elect them. That's why control of the money supply was given to the supposedly independent and supposedly non-partisan Federal Reserve. The politicians can tax and borrow as much money as their constituents let hem get away with, but they can't print money. Only the Federal Reserve has the power to create more money. That effectively puts some restraint on just how much spending the federal government can get away with and limits the damage to the economy that free-spending politicians can do. It seems to me, though, that it's possible that the independence of the Federal Reserve was effectively destroyed on Wednesday. It would appear to me that while President Obama doesn't have the legal power to make the Federal Reserve create more money, he effectively tied their hands. Obama's massive spending package passed last month and his proposed FY2010 budget guaranteed that there would not be enough money in the world for the U.S. government to borrow. Even if foreign lending doubled to $400 billion and Americans started saving at our historical average of 8% ($830 billion)  and invested it all in U.S. Treasury bonds, that would still only be $1.23 trillion. That means that the government would still come up about $600 billion short this year. and invested it all in U.S. Treasury bonds, that would still only be $1.23 trillion. That means that the government would still come up about $600 billion short this year.The psychological ramifications in the financial world of the news that the U.S. Government couldn't borrow all the money it wanted would most likely be an economic bombshell that would tank the world economy. That news would be akin to hearing that Superman was no longer faster than a speeding bullet, that water was now running uphill, and that hell had in fact frozen over. This could cause a massive shock to the confidence the financial world has always had in the U.S. Government. Instead of a "flight to safety" and investing their money in U.S. debt, investors (and foreign countries such as China) would be tempted to all cash in their bonds at pretty much the same time to make sure they got back what they had loaned us. Instead of a "run on the bank," it would be a run on the U.S. Government. And since the U.S. Government currently owes the public $6.7 trillion  (which it doesn't have), this would lead to a default by the government. Again, the worldwide ramifications of a default by the U.S. Government cannot be overstated. (which it doesn't have), this would lead to a default by the government. Again, the worldwide ramifications of a default by the U.S. Government cannot be overstated.While Obama couldn't legally force the Federal Reserve to create more money to pay for his spending, the consequence of the Fed not creating the money would be the financial collapse of the U.S. The Fed's purpose is to stabilize the U.S. economy so they would not make a decision that would lead to its collapse. Obama basically played a game of chicken with the Federal Reserve. The question was who would blink first. The Federal Reserve did.

Indeed it would seem I'm not the only one thinking the way I'm thinking. When the Fed finds it necessary to reaffirm its independence, it's probably a safe bet that it's not all that independent anymore. Indeed it would seem I'm not the only one thinking the way I'm thinking. When the Fed finds it necessary to reaffirm its independence, it's probably a safe bet that it's not all that independent anymore.This Isn't Your Everyday Monetary Expansion Critics of my position will point out that the Federal Reserve's job is to expand and contract the money supply as needed. It's what they do and it's what they've always done. During a recession the money supply is generally allowed to expand in order to promote growth. During an expansion the money supply is supposed to be more restrictive to impede unsustainable growth. This is true. The difference is that the Federal Reserve normally accomplishes these goals by increasing or reducing interest rates or by altering the reserve requirements of banks. These actions generally provide sufficient incentive for the free market to ramp up economic activity all by itself. Market forces and fractional reserve banking, driven by increased demand, lead to a de facto increase in the money supply simply by the multiplicative effect of banking. That's not what's happening here. In this case, the Federal Reserve is not creating incentives for the free market to engage in economic activity and grow the economy and money supply. Rather, the Federal Reserve is creating and dumping money into circulation to allow the federal government to try to push the economy with its federal spending. Consider the following: Many Fed watchers had expected officials to raise the size of the mortgage programs. However, the decision to buy Treasury securities came as a surprise since the Fed had sent no signal it intended to move so soon on that idea, first floated by Mr Bernanke in December. In their statement on Wednesday, however, the Fed policy makers offered little explanation for the decision to go ahead with the Treasury purchases after all, saying only that the move was intended to 'improve conditions in private credit markets.' This move by the Federal Reserve to purchase U.S. Treasuries (print money) surprised the market--especially since just a couple of weeks ago the Fed had indicated that it had concluded that buying the long-term Treasuries "is not the most efficient means of easing financial-market conditions." And, now that they've done it, there was "little explanation" other than it was intended to "improve conditions in private credit markets." That's certainly an explanation that can play well in the news since it did drive mortgage rates down. But considering the Fed had previously stated this was not the most efficient means of easing financial-market conditions, and considering the obvious shortfall in the government's ability to borrow money, it seems pretty likely that this was really all about printing money to loan to the government. The fact that mortgage rates were driven down in the process is, at best, a convenient temporary side-effect.

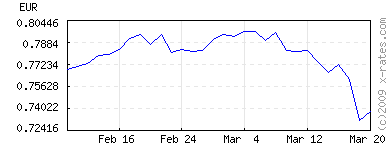

Reversing its role as the world's fastest growing buyer of US treasurys and other foreign bonds, the Chinese government actually sold bonds heavily in January and February before resuming purchases in March, according to data released during the weekend by China's central bank. So instead of loaning us $153.9 billion in the first quarter like they did in 2008, China only loaned us $7.7 billion. China, our primary lender, has drastically cut back the amount they're loaning us. The money crunch for the Federal Government is critical. And that's why the Federal Reserve started printing money when it did. The Nuclear Option Creating money--as Obama effectively forced the Federal Reserve to do--is basically the "nuclear option" of a central bank. It's not a decision that is taken lightly and it's generally not an option that is utilized if there is any alternative. As was reported in a Reuters article: ... Analysts worry that monetary policy has passed a point of no return with the printing of money. Unless a different course is taken soon, this potentially leads to runaway inflation such as in Zimbabwe.  Unfortunately, Obama left the Fed with no other option. And I'm guessing that in the Fed's private, closed-door meetings, they asked themselves, "If we refuse to create more money, will Obama really press forward with his spending all the way until the day that the government can't borrow any more... and cause an economic earthquake that will collapse the U.S. Government?" I think it's very possible that they asked themselves that question and decided the answer was, "Yes, he will." By creating more money, they have bought us some time. But not much. Note that the Federal Reserve's statement is that they plan to buy $300 billion in U.S. Securities over the next six months  . If government spending continues as proposed it's almost certain that the Federal Reserve will have to buy more U.S. Securities (i.e. print more money) by the end of the year. Just as there isn't enough money for the government to borrow today, there won't be enough for the government to borrow in six months. . If government spending continues as proposed it's almost certain that the Federal Reserve will have to buy more U.S. Securities (i.e. print more money) by the end of the year. Just as there isn't enough money for the government to borrow today, there won't be enough for the government to borrow in six months. The problem with the "nuclear option" of printing money is that once you start, it's hard to stop. When the Fed announced its decision to print money, the value of the dollar immediately dropped (see graph to the right). That means that foreigners that had invested in the U.S. (Treasuries or even in the stock market) automatically lost money because the dollars they had invested are now worth less--and they'll continue to lose money if the dollar gets weaker. If that happens, foreign investors will tend to reduce future investments in the U.S. since they prefer not to lose money. With reduced foreign investment the shortfall between what the government wants to borrow and what the world wants to lend it will increase... which means the government will, again, be faced with the decision of reducing spending or printing even more money. The problem with the "nuclear option" of printing money is that once you start, it's hard to stop. When the Fed announced its decision to print money, the value of the dollar immediately dropped (see graph to the right). That means that foreigners that had invested in the U.S. (Treasuries or even in the stock market) automatically lost money because the dollars they had invested are now worth less--and they'll continue to lose money if the dollar gets weaker. If that happens, foreign investors will tend to reduce future investments in the U.S. since they prefer not to lose money. With reduced foreign investment the shortfall between what the government wants to borrow and what the world wants to lend it will increase... which means the government will, again, be faced with the decision of reducing spending or printing even more money.The decision to print money is potentially a death spiral.

"The market is looking at the over $1 trillion deficit and how we'll finance it and concluding it is too big to finance without Fed assistance. But Fed assistance is causing inflation worries," says James Bianco, president of Bianco Research. "We're caught in a vicious cycle." The real risk, however, is that a vicious circle develops: As rates rise over concerns about the government rescue effort, consumers and businesses face higher borrowing costs, which, in turn, work against the rescue, putting added pressure on rates. The big fear is that higher yields will stall the recovery in the economy, creating a negative feedback loop, resulting in greater buying of government debt by central banks. This is exactly what I originally wrote about in this article back in March. This is just simple economics and no-one should be at all surprised by the result of this policy. So What Are They Thinking? The theory that they're subscribing to is two-fold:

If this works the way the policymakers want it to, the Fed's action will avoid the trap of deflation. Likewise, the Obama administration is betting that if the government spends all this money quickly, it will create jobs and the people with those jobs will spend the money they earn on other things, which increases economic activity, and that is what will lead to a recovery. Eventually the economy takes off under its own power and the government can scale back its spending. Once the recovery is underway, the Federal Reserve starts trying to remove some of this new money from the economy to avoid rampant inflation... and at that point we're back to normal. If that ideal situation does not happen, however, there are two major risks:

Who knows. Nobody does. Not Obama, not Bernake. Welcome to their economic experiment. And we're all the guinea pigs. But printing money to pay for government spending isn't a concept that has a particularly good track record. As I wrote back in November, we're experiencing a crisis of confidence. When the American people have confidence in our economy and our government's plan, we'll start spending money. The Obama administration is betting that their policies will lead to a situation where people have renewed confidence and will start spending. However, I'd submit that Obama's policies will not lead to any significance confidence. For all the hundreds of billions in his spending package, most people aren't going to notice the difference. The unemployment rate is expected to continue rising. And considering his policies are leading to the need to print dollars for the first time in nearly half a century, it seems likely that this will cause an erosion of confidence. If it works, we can count our blessings since we'll have dodged a bullet. But if it doesn't work then we're looking at the potential for some massive inflation, a devaluation of the dollar, and--in a worst case scenario--perhaps suggestions that, in order to avoid hyperinflation and the financial collapse of countries worldwide, the world adopt a worldwide global currency to replace all the failed currencies... including the dollar. So let's all hope this works--because if it doesn't, it's going to be a very different world.

Update 3/23/2009: Two days after I wrote the above article, Senator Judd Gregg (R-NH) had the following to say: 'The practical implications of this is bankruptcy for the United States,' Gregg said of the Obama's administration's recently released budget blueprint. 'There's no other way around it. If we maintain the proposals that are in this budget over the ten-year period that this budget covers, this country will go bankrupt. People will not buy our debt, our dollar will become devalued. It is a very severe situation.' Go to the article list |