|

Craig Steiner, u.s. Common Sense American Conservatism |

|

|

About Me & This Website My Positions On Facebook Contact Me Articles |

Don't get me wrong. Taking back the White House is extremely important. But the biggest danger to our country right now is out-of-control deficit spending, and we can (and must) address that now. We can't wait. And while the importance of electing a good president cannot be understated, getting our spending under control is even more important. Regardless of whether or not the next president is Republican or Democrat, it's absolutely critical that we get our spending and budget deficit under control. There will be serious consequences if we keep trying to borrow and spend this much money with such large deficits. And if we don't address our deficits this year it's even less likely we'll do it in a presidential election year which means we'll put it off until 2013. I don't think we can get away with ignoring the problem that long. The potential consequences of failing to resolve our deficit include high inflation, high unemployment, high interest rates, lower home values, loss of value of the dollar, loss of the status of the dollar as a reserve currency, a bond crisis that would effectively shut down the government overnight, and an economic collapse--not just of the United States, but of the world. All of these are very real possibilities. They're not exaggerations. The only questions are which of these possibilities will occur, in what order, and when. To emphasize, the latter question is when, not if. It's probable that we can't avoid these consequences entirely. Decades of reckless deficit spending--and astronomical deficit spending for the last few years--guarantee that we're going to experience most of the these consequences to some degree regardless of what we do now. But we can lessen their severity by getting our deficit spending under control. And we can still avoid a bond crisis--and a bond crisis would be the kind of seismic economic event that could have devestating effects on the economy. The Bond Crisis A bond crisis will occur when the federal government wants to borrow money from the public (from citizens, investment firms, or foreign governments), and no-one wants to loan the government money... or, more likely, will only loan money at an extremely high interest rate. The most likely scenario is that there will always be someone that's willing to loan money to the United States--the question just becomes at what interest rate? In a bond crisis the government issuing the bonds has to offer a much higher interest rate due to the perceived risk of the country not paying the money back. In order to entice investors to loan money to the government, a much higher interest rate is paid. The problem is that the United States, with a $14 trillion national debt, cannot afford to pay a higher rate of interest. Obama's budget proposal  outlines interest rates of 3.2% this year going up to 5.3% in 2021, and that produces interest payments of $205 billion this year to $928 billion in 2021. And the projected annual deficit is going from $841 billion in 2015 to $1,116 billion in 2021. That means in 2021, 83% of the money we borrow will be to pay interest on money we've already borrowed. outlines interest rates of 3.2% this year going up to 5.3% in 2021, and that produces interest payments of $205 billion this year to $928 billion in 2021. And the projected annual deficit is going from $841 billion in 2015 to $1,116 billion in 2021. That means in 2021, 83% of the money we borrow will be to pay interest on money we've already borrowed.So if instead of 5.3% interest in 2021 we're paying 15.8% (like we did right after Carter), our interest will be $2.7 trillion per year, and our annual deficit will be almost $3 trillion... almost all on interest! Using Obama's own estimates, the GDP in 2021 will be $24 trillion per year. So we'd be paying 11% of our GDP on interest. Considering that economists generally consider  a 3% deficit "sustainable," the fact that we'd have an 11% deficit just to pay for interest indicates just how ridiculous the proposition is. a 3% deficit "sustainable," the fact that we'd have an 11% deficit just to pay for interest indicates just how ridiculous the proposition is. Obama's budget proposal (the Democrats' spending plan) is dangerous because it assumes we can keep borrowing trillions of dollars per year without consequences. And it's based on extremely optimistic improvements in unemployment, extremely favorable interest rates for the next decade, and absurdly strong growth (4-6% growth each year for the next decade, with no slowdowns). If any of those assumptions are wrong, Obama's proposal is nothing short of a catastrophe. When Will It Happen?

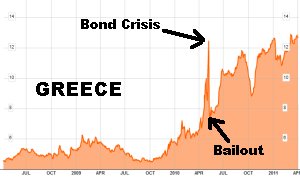

There are those that think this is a theoretical problem... that it will either never happen to us, or it won't happen for a long, long time. In other words, they think we still have time to ignore the problem so we don't have to make the hard decisions right now. But when a bond crisis happens, it can happen very quickly--without warning. As shown in the graphs to the right, Greece went from fairly normal interest rates in October 2009 to bond crisis and bailout in May 2010--just seven months. Ireland went from normal interest rates in June 2010 to crisis and bailout in November the same year--just five months. Once the crisis begins to unfold, it's very unlikely that large enough measures can be taken quickly enough to stop the crisis from playing out. Looking at the Portugal graph to the right, when Greece confronted its bond crisis in May 2010 Portugal immediately took notice and realized it had to reduce its deficit or it would suffer the same fate as Greece. And while public pronouncements of its intent to do so did temporarily reassure markets and drive its interest rates down, they've been going up faster and faster ever since. In April 2011--eleven months after they realized they had a problem and tried to take action to fix the problem--they still requested a bailout. The common theme is that a bond crisis goes from "yeah, we know we have a problem we need to fix in the future" to "we have a problem we should have fixed yesterday" very quickly. And once it's clear there's a problem, it's generally too late to avoid the final bond crisis. Consequences of a U.S. Bond Crisis In the case of Greece, Ireland, and Portugal, the European Union was available to bail them out. Even then, interest rates continued to increase for both Greece and Ireland after the initial bailout--so even those bailouts have been little more than stopgap measures, not real solutions. But in the case of the United States there will be no-one to bail us out. Greece is a $329 billion economy. Ireland is a $229 billion economy. Portugal a $233 billion economy. The United States, on the other hand, is a $14.1 trillion economy. If Greece, Ireland, and Portugal--with a combined economy of $791 billion--are causing this much grief for Europe and the world, can you imagine the fallout of a bond crisis in a $14 trillion economy? Some of the consequences of a U.S. bond crisis could be:

Focus on FY2012 It is in the context of these huge threats to our economy that the matter of cutting spending takes on such importance. Republicans are not insisting on budget cuts just for fun, or to pick a needless fight with Democrats. Getting our fiscal house in order is something our country can't put off any longer. The prize is the FY2012 budget. If Republicans can get a plan like Paul Ryan's adopted, that'll be a major change in our fiscal course. It's not a complete solution since it still contemplates large deficits for years to come. But it's a significant enough change that I'm very optimistic that it would put the bond markets at ease long enough for us to truly shore up our finances over the next few years. It buys us time. On the other hand, if Democrats not only reject this proposal but refuse to come up with a credible plan for deficit reduction themselves, I fear that the moment of reckoning of a bond crisis will be even sooner. To date, everyone (even Democrats) say they agree that we have to get our fiscal house in order eventually, and the bond market has taken those words at face value. But "eventually" is now. If Republicans try to make meaningful reductions in our deficit and Democrats absolutely refuse, the bond markets could easily conclude that our politicians will never be able to address the issue--and that could provoke the very crisis we're trying to avoid. Even as Republicans are fighting Democrats for some minimal concessions toward fiscal responsibility, Portugal has succumbed and is asking for a bailout. First it was Greece, then Ireland, and now Portugal. The dominoes falling in Europe should be a stark reminder to politicians in the United States of where we're heading if we continue on our current course. The stakes could not be higher. The FY2012 budget is our primary battle and it will be won or lost in the next six months. And if we lose the battle for the FY2012 budget, the presidential election might be of very little importance. If a bond crisis happens before the 2012 election, the damage to our country will already be done. Go to the article list |