|

Craig Steiner, u.s. Common Sense American Conservatism |

|

|

About Me & This Website My Positions On Facebook Contact Me Articles |

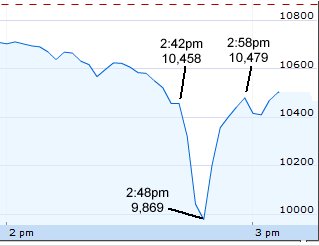

The search is on for an explanation. Numbing to Watch In Real-Time I'm not a professional investor so I'm not glued to the stock market all the time. However, I do usually check it from time to time during the day. On Thursday it just so happened that I checked the stock market just as the collapse was beginning. Coworkers and I were awestruck as we hit "reload" on my web browser, with every page reload resulting in another substantial drop. Although I lost no money, I was still numb as I watched the market plummet from a loss of about 200 points and blow through century after century... 300, 400, 500, 600, 700, 800, 900. Just when it looked like it was going to blow past a 1000 point loss, it started recovering just as quickly. The day ended with a net loss of 347--which under normal circumstances would be major bad news in and of itself. But after recovering from nearly 1000 points, many people were counting their blessings. A Play By Play of the Collapse Markets were already significantly lower when the collapse began. Protests and riots in Greece, signals from the European Central Bank that it won't print money to buy Greek debt, a quickly-falling Euro... There was no shortage of valid reasons for the stock market to drop. But the nature of the drop from 2:40pm to 3:00pm was bizarre.  At 2:42pm the market was at 10,458 and started going straight down. It lost nearly 600 points in six minutes, bottoming out at 9,869 at 2:48pm. It then started going straight up almost as quickly, rebounding about 600 points in the next 10 minutes. The abysmal drop and subsequent rocket-style rebound was completely unnatural. Usually, even in a declining market, the index will have a downward trend with momentary spikes back up, and then drop further. An unmitigated collapse like this is very unusual. Just as unusual was the fact that there was no news specifically at 2:42pm to justify a sudden collapse, nor any different news that would justify the market bouncing back at 2:48pm. In short, while I've been predicting the potential of a serious end-of-April correction since last November, the nature of today's collapse indicates it wasn't a rational reaction to anything in particular. The general downward trend of the market over the last two weeks makes sense; and today's overall drop, sure. But it seems clear that market's movement during those mysterious 20 minutes was not in response to anything specific. Looking for a Reason Due to the very unusual and extreme nature of Thursday's market movements, government agencies, officials of the stock exchanges, investment bankers, and average guys like me are all looking for an explanation of what happened. It has already been written that those 20 minutes today were most likely the most exciting 20 minutes in the history of world markets. It was just astounding to watch it happen, and we want to know why. Some alleged evidence and theories are already being proffered:

Personally, I have a hard time accepting the "fat finger" explanation. First, it assumes that someone that meant to sell a million items (dollars or shares or whatever) actually had a billion of them to sell. You can't accidentally sell a billion dollars/shares unless you have them. And would someone with a billion units of an asset really be intending to sell a million units? That is, one-tenth of one percent? I can see a computer making micro-adjustments like that, but is a trader really going to sit down and sell one-tenth of one percent of their asset? And while I'm not familiar with institutional trading systems, as a software engineer I've personally never seen or developed a system that accepts "1B" to mean a billion and "1M" to mean a million. These most likely are numeric fields that require numeric input, and I'd be surprised if systems were set up to make it that easy to make a catastrophic trade. Not only would the system have to accept such alpha-numeric input, would such a system really initiate such a huge trade without significant warnings and verification? Or without secondary authorization? I think the real question is how the stocks mentioned above dropped so much and so quickly. It seems to me that those movements of DJIA components were sufficient to start a massive stock dump that accelerated as program trading kicked in as the stock market plummeted past certain pre-programmed levels. The slide became self-sustaining until it either hit such low levels that pre-programmed buying kicked in and reversed the slide, or until the anomaly that caused P&G to drop was resolved and caused P&G to go back to its normal level--which caused the DJIA to go back up 172 points and start the climb back up. Was the Market Played? I've seen theories which suggest that the market was manipulated. After all, depending on your source, somewhere between $700 billion and $1.2 trillion was lost and earned (i.e. "transferred") in the space of 20 minutes. If someone knew this was going to happen, billions of dollars could have been made by buying the market at its low point. In my opinion, this is very unlikely. It's easy to look back at the straight-down/straight-up movement and rush to those kinds of conclusions; but even if P&G were somehow manipulated, I don't think anyone could know ahead of time it would have caused a 1000-point drop--much less that the market would subsequently rebound. And if someone made hundreds of billions of dollars on such an effort, there would be fingerprints and paper trails that would eventually reveal the guilty parties. As such, I don't think it's at all likely that the collapse could have been due to manipulation with someone intending to profit from it. An Attack? The thought of market manipulation did cross my mind, but in the context as an attack on our financial system. For years there have been concerns expressed about our vulnerability to cyber attacks. Hackers could hack their way into our water distribution system, the electric grid, air traffic control, attempt to shut down key parts of the Internet, or... attack the financial system. If a malicious hacker got into a financial exchange's network and manipulated the price of some key stocks (such as P&G), the kind of thing that happened yesterday could easily be provoked. As stated above, it seems that the trigger for the 1000-point drop was a momentary drop in the price of P&G which immediately caused a huge variation in the overall stock market index. As a software engineer with plenty of database experience, this could be achieved by temporarily "disconnecting" the reported P&G stock price from buy/sell orders that are streaming in and simply setting it to a lower manipulated price. That modified price would propagate into all other calculations (such as the calculation of the DJIA) and trigger lots of program trading, exactly as happened yesterday. My assumption is that what happened on Thursday was not an attack but just a freak confluence of market events. However, it is my opinion that what happened yesterday was exactly what an attack on our financial system could look like. Looking Forward Regardless of what happened and why, the incident couldn't have come at a worse time. Markets have been on edge and declining for two weeks. There is concern about the strength of the recovery and potentially massive sovereign debt problems in Europe. The Euro has been declining. Thursday's amazing movements in the stock market made nervous traders even more nervous. As I said back in November, I think there is a potential for a serious change in direction in the markets right about now. And that prediction was without Greece being a problem. I suspect we're going to be looking at tough times in the markets with plenty of volatility. Swim at your own risk. There's no lifeguard on duty.

Instead of "fat finger" trades, hackers or bad prints, it appears much of yesterday's nearly 1,000 point intra-day market crash was created by a lack of bids and efficiency, which created a vacuum and a subsequent panic... This actually could be more scary than the other possibilities. If this was really a situation where there were simply no buyers then that's a very strong vote of "no confidence" in the market. Go to the article list |